- Pensar Academy

- Arizona Tax Credit Program

-

The Arizona Tax Credit Program:

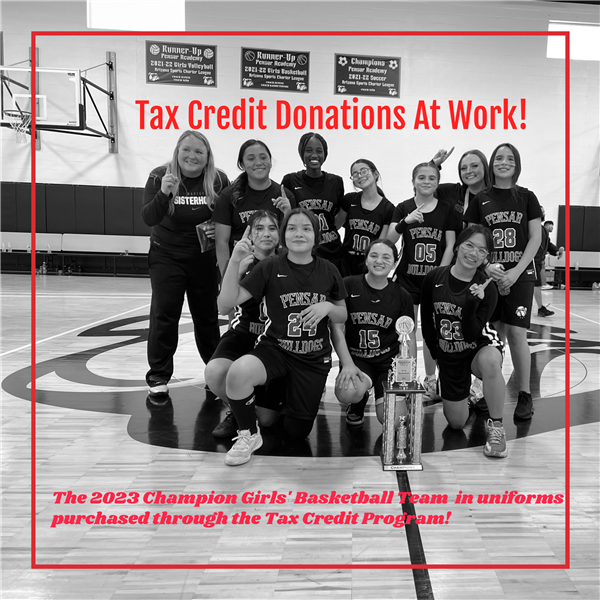

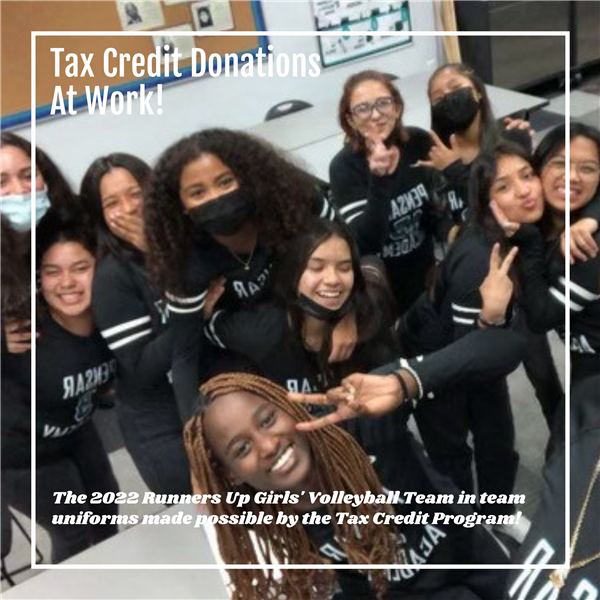

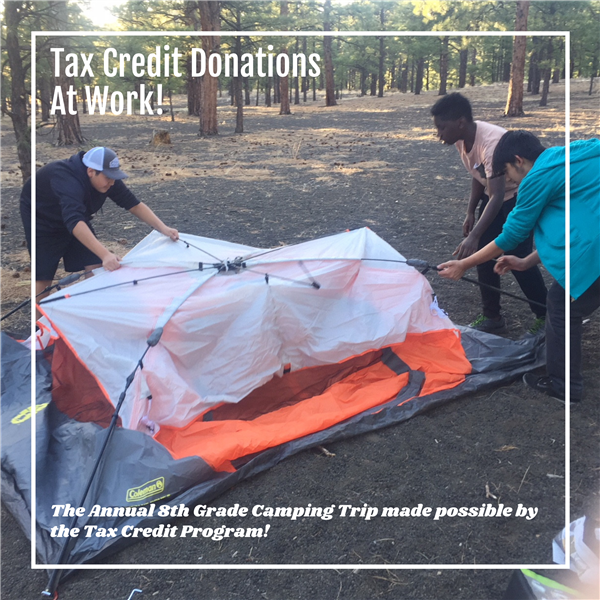

In the Gallery above, please scroll through and see a few of the many uses a tax credit donation to Pensar Academy can help fund to give Pensar students experiences they will not soon forget!

This program allows Arizona taxpayers to donate up to $200 as an individual or up to $400 for married couples (filed jointly) for extracurricular activities at the public/charter school of their choice. This donation is then credited back to the donor, dollar for dollar, upon the filing of annual taxes. Please visit the Arizona Department of Revenue website for more information or give Gerry Garcia, Director of Operations, a call at 602-383-4013 or contact via email at garcia@pensaracademy.org

FAQs:

What is the process for contributing an education tax credit?

Simply submit a payment via check to Pensar Academy by April 15, 2024 at our mailing address at Pensar Academy, 6135 N Black Canyon Highway, Phoenix, AZ 85015. The school will mail you a receipt complete with Pensar’s tax code for verification purposes. Then, when you file your annual Arizona tax return, you may deduct the amount that you donated. Dollar for dollar, you will be reimbursed for your tax credit donation!

Who can contribute an education tax credit to Pensar?

Any Arizona tax payer can contribute. You can or do not have to have a child that attends Pensar!